Introduction: Understanding Trump’s Tariff Policies

During Donald Trump’s presidency, tariff policies played a significant role in shaping the economic landscape, both domestically and internationally. Initially, these tariffs were implemented as part of the “America First” agenda, aimed at protecting American manufacturers and jobs from what was perceived as unfair foreign competition. The rationale behind enforcing tariffs was to create a more balanced trade scenario, particularly with countries like China, which Trump accused of engaging in unfair trade practices that harmed American businesses.

These trade barriers affected various sectors, including steel, aluminum, and consumer goods, leading to a ripple effect across international trade relations. The tariffs not only intensified trade tensions but also provoked retaliatory measures from affected countries. As a result, international markets faced increased volatility, with industries scrambling to adapt to the changing landscape of tariffs and trade agreements. The stock market reacted to these developments, often reflecting the uncertainty surrounding tariff announcements and negotiations.

As 2023 unfolded, the economic implications of these tariffs became increasingly evident, with many analysts questioning their long-term effectiveness. Following months of speculation, Trump announced a significant decision—a 90-day pause on tariffs. This strategic maneuver, touted on platforms like Truth Social, sparked interest and unrest within stock market circles, as investors looked to gauge the potential impact on the economy. Dow futures, along with other major stock indices such as the S&P 500 and Nasdaq, reacted positively to this unexpected news, highlighting the market’s continuous response to Trump’s tariff news.

In the backdrop of this market manipulation, questions surrounding insider trading and the transparency of policy decisions emerged. These dynamics create a complex narrative about Trump’s tariff policies, intertwining economic strategy with broader market influences. Understanding these elements is crucial for grasping the implications of the recent pause on tariffs and how it reshapes the global trade environment.

Key Announcement: 90-Day Tariff Pause

In a significant development in trade policy, President Trump has officially announced a 90-day pause on most tariffs. This decision took effect immediately and is set to reshape market dynamics for both domestic and international stakeholders. The focus of this tariff pause centers on reducing the economic strain caused by previous tariff implementations amid ongoing trade tensions. Key affected sectors include consumer electronics, industrial machinery, and some agricultural products, which may experience temporary relief from increased costs due to tariffs.

The implications of this 90-day pause on tariffs are multi-faceted. For domestic consumers, the reduction in tariffs should translate to lower prices on a range of goods, enhancing purchasing power and potentially stimulating economic activity. Businesses relying on imported materials may find themselves in a more favorable position, as reduced tariff expenses could lead to improved profit margins and a boost in investment. Conversely, international markets may react with cautious optimism, anticipating increased trade flow with the U.S. and the possibility of a more stable economic environment.

Timing is a critical element of this decision. With the clock ticking on the 90-day tariff pause, stakeholders are advised to closely monitor developments, especially as elections approach. Market analysts have noted that this pause could coincide with an effort to mitigate uncertainties affecting stock market futures. The Dow Jones, S&P 500, and Nasdaq indices are closely watching these developments, with fluctuations expected in response to tariff-related news. Furthermore, platforms such as Truth Social have already seen discussions around Trump’s tariff pause evolving into broader conversations about market manipulation and investor strategies. The focus will remain on how these changes will impact stock market trends in the coming months.

Market Reaction: Analyzing the Stock Market Rally

The announcement of a 90-day pause on tariffs has reverberated throughout the financial markets, resulting in a significant rally in key stock indexes. Following the news, major indices such as the Dow Jones, NASDAQ, and S&P 500 experienced notable increases, sparking optimism among investors. The sentiment surrounding the stock market today reflects a collective sigh of relief, as the potential for reduced trade tensions could lead to positive economic outcomes.

In the immediate aftermath of the tariff pause announcement, stock market futures surged, reflecting heightened investor confidence. Analysts pointed to the Dow futures, which jumped significantly, as a clear indicator of market optimism. The rally suggests that investors are hopeful for a more stable economic environment, particularly in light of trade policies that have previously caused volatility. This pause on tariffs allows for the possibility of renewed negotiations and cooperation, which many view as favorable for economic growth.

Notably, sectors that were previously pressured by the looming threat of tariffs saw substantial rebounds. Technology stocks, for instance, benefited significantly as investors anticipated that eased trade tensions would bolster international sales—especially for companies reliant on overseas markets. Similarly, manufacturers and retailers experienced upward momentum, as a pause on tariffs could potentially lower costs and increase margins. Companies that had previously faced uncertainty due to tariffs found their stock prices climbing, further fueling the market rally.

The investor mood, as reflected in social media trends and platforms like Truth Social, has also aligned with positive sentiment. Conversations around “trump tariffs” and the “90-day pause” dominated discussions, indicating that the tariff news has captured the attention of the wider public, not just financial analysts. Overall, the initial reaction to the tariff pause has invigorated the stock market, setting a tone of cautious optimism among investors eager to capitalize on potential growth opportunities.

Economic Implications: Potential Short and Long-Term Effects

The recent announcement regarding the 90-day pause on tariffs implemented by former President Donald Trump has stirred considerable interest across various economic sectors. In the short term, businesses and consumers are likely to experience immediate benefits as the reduction of tariffs can lead to lower prices for imported goods. This reduction may stimulate consumer spending, subsequently boosting demand within the domestic market. As products become more affordable due to the tariff pause, retailers may also see an uptick in sales volume, which can positively impact the stock market, including indices like the Dow and S&P 500.

Moreover, businesses can take advantage of the temporary relief provided by this pause. Companies dependent on imported raw materials may find it easier to manage costs without the added financial burden of tariffs. Enhanced liquidity in the market, often reflected through rising stock prices, could lead to increased investment opportunities, as firms feel more confident in their financial forecasts and operational plans. Notably, sectors such as manufacturing and retail might experience a short-term surge in activity as they recalibrate to take advantage of the new regulatory landscape.

However, it is essential to consider the potential challenges that the tariff pause may present in the longer term. While it might alleviate immediate pressures, industries relying heavily on tariff protections may face difficulties as competitive dynamics shift. Additionally, prolonged trade uncertainties and sporadic tariff-related news can result in market manipulation or reactions from investors, influencing stock valuations. Furthermore, the long-term effects on trade relations could lead to a reassessment of international partnerships, impacting economic growth trajectories. The intricate balance between managing trade tensions and fostering economic stability remains a pivotal challenge for policymakers moving forward.

Expert Opinions: Insights from Economists and Trade Analysts

The recent decision by the Trump administration to pause tariffs for 90 days has garnered a wide array of insights from economists and trade analysts. Many experts are analyzing the implications of this tariff pause on both domestic and international trade, as well as its potential effects on the broader economy. For some economists, the 90-day tariff pause represents an opportunity for both American businesses and international partners to recalibrate their strategies and reduce uncertainty in the market. The short-term nature of the pause suggests that businesses should be poised to adapt quickly as they anticipate an eventual return to normal tariff conditions.

Trade analysts have noted that the 90-day pause on tariffs could serve as a bridge to more comprehensive trade negotiations. The potential of an extended tariff halt may encourage dialogue among trading partners, fostering an environment conducive to addressing disputes that have long plagued global trade relations. However, doubts remain regarding the sustainability of this approach, as analysts point out that a temporary pause without substantive changes may simply prolong existing issues. Furthermore, the focus on recent developments in the stock market raises questions about whether this rally is based on genuine economic fundamentals or mere market speculation in response to the tariff news.

Furthermore, there will be significant impacts on markets, including the Dow Jones and S&P 500, with futures responding to news of the Trump tariff pause. Observers speculate that this could prompt investors to rethink their positions on sector stocks most affected by tariffs, creating both opportunities and risks. As experts dissect these nuanced outcomes, they emphasize the importance of closely monitoring the developments surrounding the tariff pause, particularly as it relates to stock market performance and potential market manipulation concerns. The insights from these economists and analysts illustrate the complex interplay between tariffs and market dynamics, revealing a landscape rich with potential volatility as the 90-day window unfolds.

Comparative Analysis: Tariff Policies Around the World

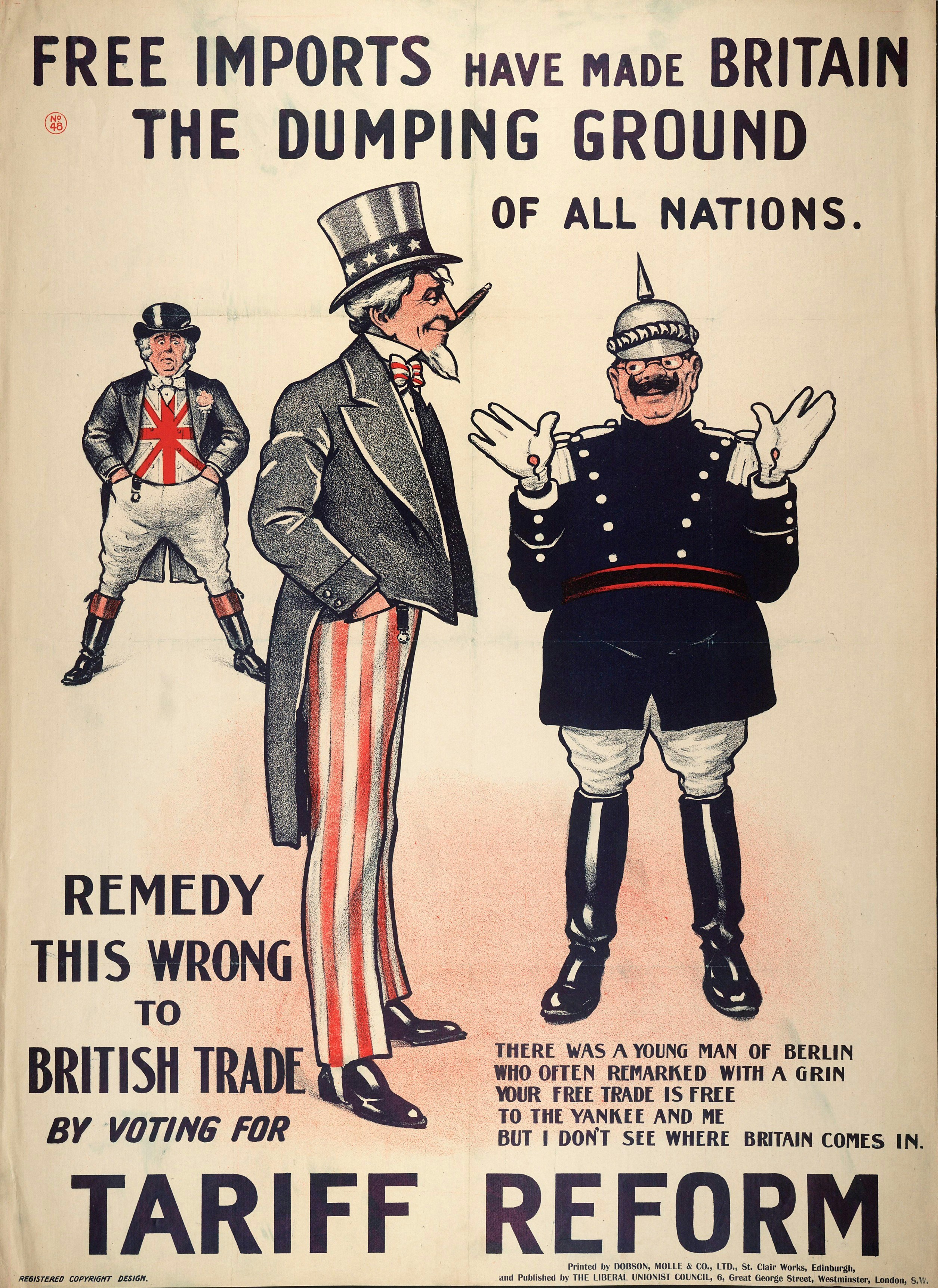

Tariff policies are a fundamental aspect of international trade that significantly influence economic conditions and market dynamics across the globe. This analysis focuses on the approaches adopted by key economies such as the European Union (EU) and China, contrasting them with the tariff strategies implemented during Donald Trump’s administration. Understanding these policies can provide insights into current market behavior, particularly following recent developments, such as the 90-day pause on tariffs announced by Trump, which has implications for stock market futures including Dow Jones and Nasdaq indices.

The EU maintains a relatively unified tariff structure, establishing common external tariffs that promote a level playing field among its member states. Recent policies have been aimed at both protecting European industries and fostering free trade agreements with various nations. In contrast, Trump’s approach to tariffs focused on protectionist measures, including imposing high tariffs on imports from countries like China. This led to increased tensions in global trade relations and fluctuations in stock market responses, as markets reacted to potential supply chain disruptions and increased costs for consumers.

China’s tariff policies have similarly evolved in response to global economic pressures. Historically, China has used tariffs as a tool to support domestic industries, mirroring the protectionist stance seen during the Trump administration. However, with ongoing trade negotiations, China has also explored reducing tariffs as a strategy to enhance its competitive stance in international markets. This dynamic creates a contrast that underlines the significance of tariff pauses; both the Trump administration’s tariff pause and China’s adjustment strategies impact global trade flows and subsequently, stock performances across major indices.

The interplay between these differing tariff policies contributes to a complex global trade environment. Market observers should pay close attention to tariff news as changes may significantly affect stock market directions, including updates on taxes levied that might be alternatively paused or implemented by multiple countries. The 90-day pause on tariffs, prompted by Trump, opens new avenues for potential negotiations and impacts on international market stability.

Consumer Impact: What the Tariff Pause Means for Everyday Americans

The recent announcement of a 90-day pause on tariffs has elicited varied responses from different sectors of the economy. This provisional measure, often characterized by supporters as a move towards fostering consumer stability, is notably expected to affect American consumers in several ways. One of the most immediate implications revolves around price fluctuations. Typically, tariffs increase the costs of imported goods, which are often passed down to consumers. Thus, with the suspension of these tariffs, we may see a stabilization or even a decrease in prices for everyday items, ranging from electronics to clothing.

Furthermore, the pause is likely to enhance the availability of products in the market. The removal of tariffs can incentivize suppliers to continue importing goods without the added burden of higher costs, thus maintaining inventory levels. This increase in supply can lead to better availability of products in stores and online platforms, benefitting consumers eager to make purchases without facing shortages or potential price hikes associated with higher tariffs.

Consumer behavior may also shift as a result of the tariff pause. With the anticipation of lower prices and better availability, many shoppers might be encouraged to spend more, contributing to a short-term boost in consumer confidence and spending patterns. This change could have a ripple effect across various sectors, subsequently affecting stock market performance, including indices like the S&P 500 or Dow Jones, as increased consumer spending may drive economic growth.

It remains crucial, however, to consider that while a tariff pause may provide immediate benefits, the long-term implications on the economy and various industries will require close monitoring. The interaction between consumer behavior and market dynamics post-pause will undoubtedly be a focal point in ongoing tariff news coverage. Therefore, the upcoming weeks will be pivotal in assessing the true impact of this single decision on everyday Americans and the broader economic landscape.

Political Reactions: Responses from Key Political Figures

The announcement of the 90-day pause on tariffs has elicited a broad spectrum of reactions from key political figures, reflecting the divisive nature of Trump’s policy decisions. Supporters of Trump have largely welcomed the tariff pause as a strategic move to stimulate the economy and foster a more favorable environment for job creation. Prominent Republicans have taken to various platforms, including Truth Social, to express their approval, arguing that this decision could potentially amplify investor confidence and enhance market stability.

On the other hand, critics and opponents of Trump’s tariffs have raised concerns regarding the implications of such a pause. Many Democrats have criticized the decision as a short-term fix that neglects the root causes of market volatility. They emphasize that while a temporary cessation of tariffs might provide immediate relief, it does not address the underlying issues of international trade relations and market manipulation allegations associated with Trump. Some have even cited concerns about potential insider trading implications as they anticipate how stock market futures, including Dow Jones and S&P 500 trends, may react to this news.

Leading voices in the Democratic party question the motives behind the tariff pause, hinting at possible political maneuvering ahead of upcoming elections. The perception that Trump is using tariff adjustments to bolster financial markets and his own political capital has become a topic of heated debate. Influential commentators on various news networks, like CNN and CNBC, have also weighed in, analyzing the potential impact of the tariff news on market dynamics, further fueling discussions around Trump’s insider trading practices.

Ultimately, the mixed responses to the tariff pause underscore the complexities of economic policy and political strategy in the 21st century, creating a dynamic environment that will continue to evolve as stakeholders respond to the implications of Trump’s decisions.

Conclusion: Future Outlook on Tariffs and Market Trends

The recent announcement regarding the 90-day pause on tariffs marked a significant moment in the ongoing trade dynamics. As businesses and investors absorbed this news, stock market futures reacted positively, reflecting increased optimism. The pause initiated by Trump, often referred to as “Trump Tariffs,” has been seen as a strategic move to alleviate pressure on the market, particularly when considering the rising tensions in international trade. The potential for growth in sectors affected by these tariffs has led to bullish behavior in the Dow, S&P 500, and Nasdaq, with many observing spikes in market movements.

Looking ahead, the implications of this tariff pause raise important questions about future trade policies and their impact on market trends. Many analysts speculate that if the current administration continues to adopt a favorable stance towards tariffs, it may foster a more stable trading environment, encouraging investor confidence and market growth. However, the specter of future tariffs remains, as ongoing discussions and negotiations may yield different results. Will Trump ultimately reverse the pause, and if so, how will that affect stock prices and the general economic climate? Investors are closely monitoring developments on platforms like Truth Social and stock news outlets to gauge the sentiment revolving around potential market manipulation, insider trading, and policy shifts.

In summary, the tariff pause reflects a carefully considered approach to mitigating market disruptions. As we move forward, possible adjustments to tariffs will likely have significant implications for the stock market. Stakeholders should remain vigilant in tracking both the anticipated impacts of this 90-day pause and the broader economic signals that will influence their investment strategies in the coming months. The evolving landscape of tariffs and trade policy will continue to shape market trends and investor behavior.

Leave a Reply